In the ever-evolving world of technology, there's a new star on the rise—Generative AI. You've seen the jaw-dropping demos and read the buzzworthy predictions. But while the hype is real, you might be thinking, "This isn't relevant for my organization." Maybe your work involves hands-on tasks like construction or home repair, or perhaps you believe your company is too small or lacks the tech-savvy to harness AI's potential.

Let me set the record straight: every organization, regardless of size or tech proficiency, can tap into the power of Generative AI. Platforms like WebWidgets.io make it possible to bridge the gap, connecting your data and users to cutting-edge AI systems from leading companies like OpenAI and Anthropic.

I'm going to use the important workflow of loan underwriting as an example of how this can work. Loan underwriting exemplifies many tasks in the modern economy that require extracting data from numerous sources, followed by analysis and composition or summarization. These characteristics are not unique to banking; they are common across various industries. The strategy that works for loan underwriting can be applied to many tasks within your company, making GenAI a powerful tool for enhancing productivity and efficiency in diverse areas.

Loan Underwriting: an Example Task

Loan underwriting is a critically important task in the world of banking. It is generally performed by professionals called Credit Analysts. The underwriting process begins when a client comes to the bank with a loan request. The bank must decide whether to grant the request, how much interest to charge on the loan, and what forms of collateral or financial covenants to require from the client. The ultimate decision is made by a group of executives called the loan committee, but this committee does not have time to do all the research and analysis of every client who applies for financing. Instead, the committee bases its decision on a summary document that is produced by the underwriting process. So, loan underwriting is a process of research, analysis, and investigation of a bank client's financial situation, that produces a concise summary report, which can be used as the basis for making loan decisions.

At the highest level, loan underwriting can involve a deep familiarity with the client's history, personnel, and business. AI systems cannot yet achieve this high level of performance. But in practice, many loan requests are quite standard and do not require deep analysis. A lot of the work involves looking up numbers in the client's financial documents and plugging those numbers into the bank's spreadsheets. Sometimes the analyst must search through the client's web site to find information about the executives, and compile this information into a single paragraph in the loan document. For tasks like information extraction and summarization, the new Large Language Model (LLM) technology is extremely capable.

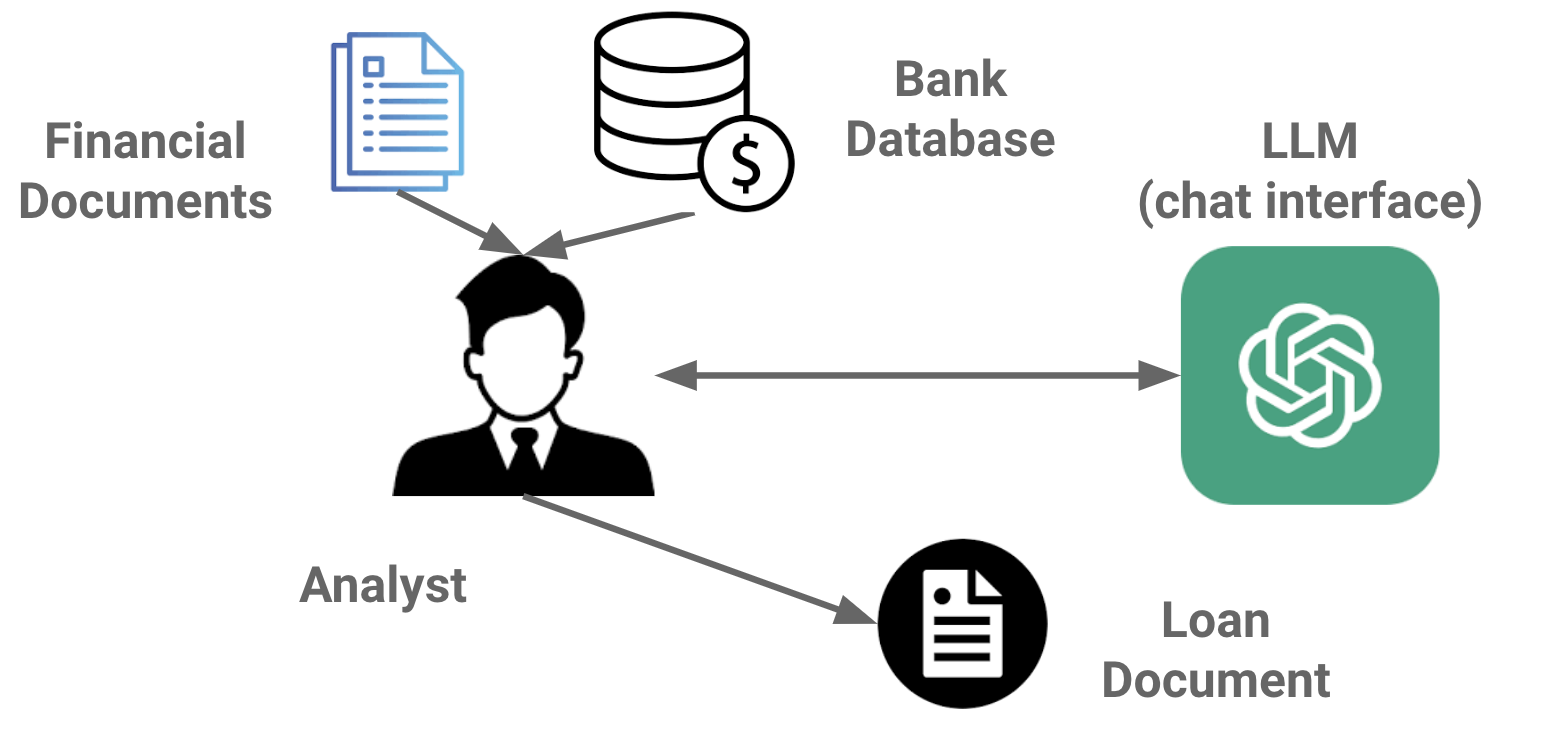

For a task like loan underwriting, GenAI can likely already provide a productivity boost, out of the box, without any extra technology development - though this setup would not be optimal. This can be achieved simply by having the human analyst copy and paste data back and forth into the chatbot interface (e.g. ChatGPT). The human would upload a variety of client documents to the chatbot, and then issue commands to it such as "Please scan this document and calculate the debt service coverage ratio for the fiscal year 2022." The bot would automatically scan the document(s) and find the relevant numbers, which the analyst would then copy into the bank's standard spreadsheet. That process might go on for a while, depending on how many statistics need to be extracted. The analyst might also make summarization requests, for example, "Please describe the overall trajectory of the client's business over the last 3 years". The analyst might have an extended discussion with the chatbot based on the client documents, relying on summary descriptions for general concerns, or delving into details that are of special interest. The analyst could then select which components of the discussion to copy into the loan document - perhaps also asking the chatbot to revise the finished product into a coherent narrative as a final request.

While the above strategy would likely produce a productivity boost, it stil requires a lot of effort on the part of the analyst. The analyst still need to interact with the bank's databases and computer systems. S/he also has to do a lot of manual copying of data from the documents into the chatbot and vice versa. The analyst might not do a great job at prompting the chatbot effectively - Prompt Engineering is still a nascent art.

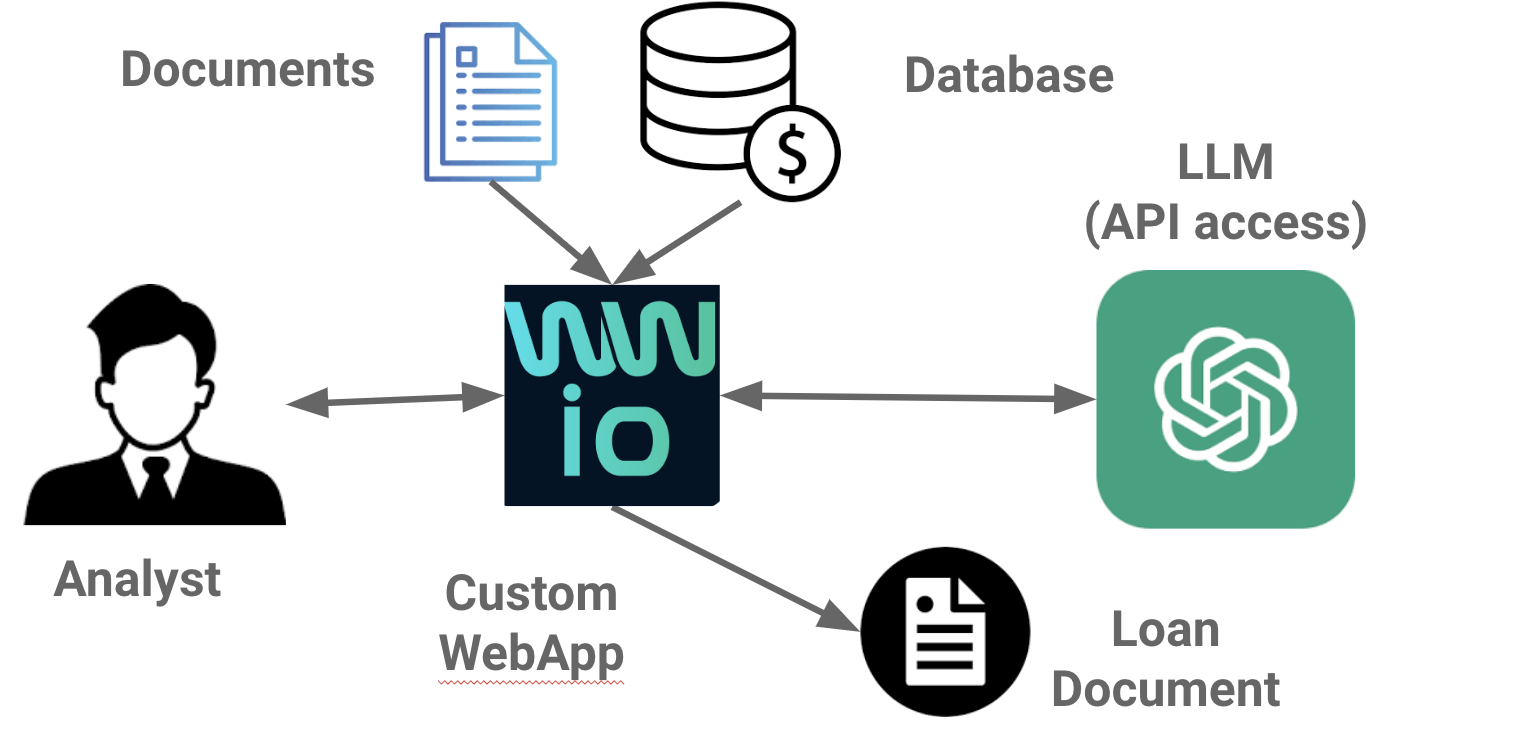

A better process would use a single, central application that manages all of the data flows. This application would pull data from the bank's document store and databases, and feed it into the chatbot with a single click. It could automatically send all the standard numerical questions (debt service coverage ratio for 2023, etc) to the chatbot, and copy the replies into the proper destination in the spreadsheet. The application could be programmed with standard, well-tested prompts that are known to provide good results. In this model, the analyst only has to interact with a single system, instead of switching between multiple programs to find the necessary data. The application would allow the analyst to dive deep on topics of interest or concern, or simply give a brief review and green light, as desired. Furthermore, having this system would provide the loan committee with a powerful secondary source of information: if there is some points of confusion that remain after reading the primary document, the loan approver can go into the application and clarify those points by asking the chatbot directly.

This model can be built with any software platform, but the WWIO platform is a great choice, for several reasons. First, WWIO excels at rapid experimentation and iteration, and this is essential for successful GenAI development - you need to try out a lot of different tricks and tactics to see what works best. Second, these apps will be primarily used as internal tools within an organization, and internal tooling is one of WWIO's strong points. Finally, the tool will need a lot of customization and integration with the bank's other systems, and customization is also a strong point for WWIO.